how do equipment leases work Equipment leasing is a way of acquiring all of the commercial grade equipment items that a given business might need to function properly and at its absolute best. Many business owners are starting to consider equipment leasing for its superior cost-effectiveness.

How Do Equipment Leases Work, Generally speaking leases that end in a large residual are used to rent equipment while leases that leave a small residual sometimes as small as 1 are used to buy equipment. Our guide on equipment leasing basics will get you ramped up on all your options. The leasing process.

39 Sample Equipment Lease Agreements In Pdf Ms Word From sample.net

39 Sample Equipment Lease Agreements In Pdf Ms Word From sample.net

The difference is that with an open equipment lease the hardware is appraised initially to. Ownership of the leased equipment automatically transfers to the lessee by or at the end of the lease term. Existing equipment leases can be considered in-place financing and are a form of credit that may be required by a purchaser to afford a transaction.

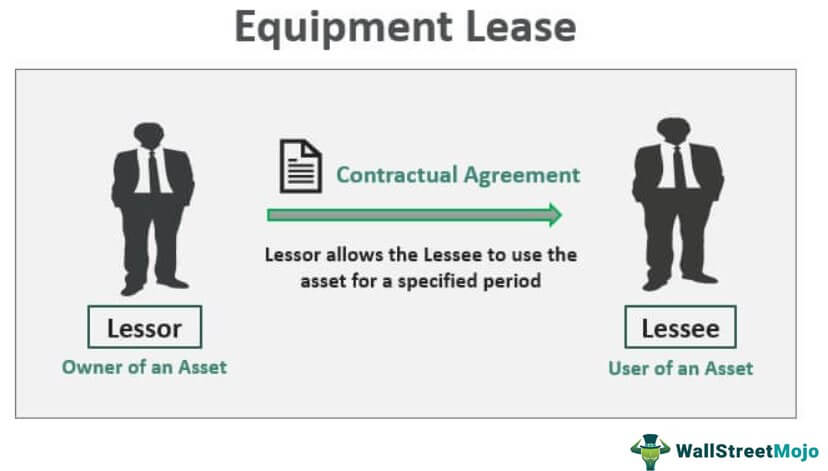

In a strict legal context the lessor remains the owner of the property.

Many business owners are starting to consider equipment leasing for its superior cost-effectiveness. There are many different leasing contracts to choose from and the right fit depends on your goals and situation. The lease contains a bargain purchase option for the equipment. Equipment leasing is the type of financing in which the small business owner rents the equipment rather than purchasing it. You pay a flat monthly rate and get equipment loaned out to you.

Another Article :

So how does equipment leasing work. This usually happens within 24 to 48 hours. A TRAC lease adds some layers of flexibility to the normal leasing arrangement. Its a great way to ensure your business has the necessary equipment to keep it up and running without having to invest capital. The previous owner of the asset to. Equipment Lease Agreement California.

Many business owners are starting to consider equipment leasing for its superior cost-effectiveness. The leasing company purchases equipment and then lends it to the user in exchange for periodic lease payments. Many businesses acquire needed assets via a lease arrangement. Usually ownership is left to the leasing company or the financial institution. A lease on its part describes an agreement that lasts 12 months or longer. Equipment Lease Agreement Types Examples And Key Terms.

The difference is that with an open equipment lease the hardware is appraised initially to. Financing is a significant element of any leasing agreement regardless of what company your. Generally speaking leases that end in a large residual are used to rent equipment while leases that leave a small residual sometimes as small as 1 are used to buy equipment. As long as you pay that rate for the duration of. The leasing company purchases equipment and then lends it to the user in exchange for periodic lease payments. Equipment Lease Agreement Types Example Calculate Lease Payment.

Many business owners are starting to consider equipment leasing for its superior cost-effectiveness. A TRAC lease adds some layers of flexibility to the normal leasing arrangement. Usually ownership is left to the leasing company or the financial institution. Many businesses acquire needed assets via a lease arrangement. Equipment leasing is a way of acquiring all of the commercial grade equipment items that a given business might need to function properly and at its absolute best. Equipment Lease Agreement Template Free Download Speedy Template.

You pay a flat monthly rate and get equipment loaned out to you. Many business owners are starting to consider equipment leasing for its superior cost-effectiveness. Equipment leasing is a way of acquiring all of the commercial grade equipment items that a given business might need to function properly and at its absolute best. The term of the lease is equal to or greater than 75 of the. Usually ownership is left to the leasing company or the financial institution. 39 Sample Equipment Lease Agreements In Pdf Ms Word.

The previous owner of the asset to. The difference is that with an open equipment lease the hardware is appraised initially to. Sale and Leaseback involve the company that owns the asset to sell it and then lease it back from the purchaser of the asset. Ownership of the leased equipment automatically transfers to the lessee by or at the end of the lease term. The previous owner of the asset to. Commercial Equipment Lease Agreement Template Lease Agreement Rental Agreement Templates Lease.

The lease contains a bargain purchase option for the equipment. In a strict legal context the lessor remains the owner of the property. Its a great way to ensure your business has the necessary equipment to keep it up and running without having to invest capital. The previous owner of the asset to. Typically this amount is applied as a credit on closing towards the purchase price. Types Of Equipment Leases Operating Capital Leaseback Trac Efm.

Equipment leasing is a way of acquiring all of the commercial grade equipment items that a given business might need to function properly and at its absolute best. Existing equipment leases can be considered in-place financing and are a form of credit that may be required by a purchaser to afford a transaction. The lease contains a bargain purchase option for the equipment. Leasing equipment means making payments for a certain period of time through the end of the financing agreement. Equipment leasing is the type of financing in which the small business owner rents the equipment rather than purchasing it. 39 Sample Equipment Lease Agreements In Pdf Ms Word.

With a lease arrangement the lessee pays money to the lessor for the right to use an asset for a stated period of time. TRAC leases play with that formula a bit. Equipment lease financing lets small business owners invest in business growth while holding on to their working capital. Are you gathering your options. What to expect Step 1. Free Equipment Lease Agreement Template Word Pdf Eforms.

Many businesses acquire needed assets via a lease arrangement. Financing is a significant element of any leasing agreement regardless of what company your. You complete an equipment lease application. The main aim of this particular lease category is for the lessee ie. You pay a flat monthly rate and get equipment loaned out to you. 39 Sample Equipment Lease Agreements In Pdf Ms Word.

With an operating lease your business is allowed to utilize assets but doesnt provide any equipments ownership rights. In a strict legal context the lessor remains the owner of the property. However the accounting for such transactions looks through the legal. Open equipment leases work the same general way that standard leases work. The lease contains a bargain purchase option for the equipment. .

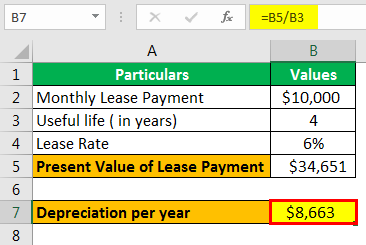

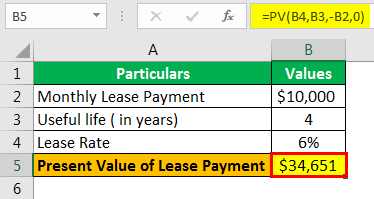

Our guide on equipment leasing basics will get you ramped up on all your options. Many businesses acquire needed assets via a lease arrangement. Equipment leasing is a form of acquisition thats alternative to purchasing or traditional lending. Usually ownership is left to the leasing company or the financial institution. In a strict legal context the lessor remains the owner of the property. Equipment Lease Agreement Types Example Calculate Lease Payment.

Equipment leasing is a way of acquiring all of the commercial grade equipment items that a given business might need to function properly and at its absolute best. Usually ownership is left to the leasing company or the financial institution. Are you gathering your options. How does an equipment lease work. With a lease arrangement the lessee pays money to the lessor for the right to use an asset for a stated period of time. 5 Types Of Equipment Leases For Your Business Southstar Capital.

You complete an equipment lease application. Here is how it works. Basically a lease is a contract that involves you getting equipment loaned to you and you in return paying a flat monthly rate for the duration of the contract period. Generally speaking leases that end in a large residual are used to rent equipment while leases that leave a small residual sometimes as small as 1 are used to buy equipment. The lessor processes your application and notifies you of the result. Equipment Lease Agreement Types Example Calculate Lease Payment.

The term of the lease is equal to or greater than 75 of the. With a lease arrangement the lessee pays money to the lessor for the right to use an asset for a stated period of time. Usually ownership is left to the leasing company or the financial institution. At the end of their lease terms business owners have the option to keep the equipment for a nominal charge. You complete an equipment lease application. Pdf The Buy Lease Or Rent Decision.