how to calculate depreciation on gym equipment When the lease ends youll have paid off the entire value. As well as Ld.

How To Calculate Depreciation On Gym Equipment, This figure represents the. 175048- claimed on gym equipments installed in the premises of Managing Director the assessees case before the AO. Its worked out by taking the original cost of the asset and dividing it by the number of years that you deem the asset will be useful to your business.

Http Www Financeassignmenthelp Net Our Finance Assignment Writing Help Corporate Finance Assignment Help Struggling With Corporate Finance Assignment Check From id.pinterest.com

Http Www Financeassignmenthelp Net Our Finance Assignment Writing Help Corporate Finance Assignment Help Struggling With Corporate Finance Assignment Check From id.pinterest.com

Multiply the year by the rate to get the depreciation expense for that year. The depreciation rate is 20 percent. Finally multiply the depreciation rate by the depreciation asset cost to calculate annual depreciation.

CITA has been that as per the corporate policy the provision of fitness centre has been done for purposes to ensure employees to stay fit and.

Straight line depreciation is usually seen as an easier method for calculating depreciation. 175048- claimed on gym equipments installed in the premises of Managing Director the assessees case before the AO. The straight-line basis equals 1900 10000 - 5005 years. How to Calculate the EBITDA of your Fitness Club or Gym. DEP - PURCHASECOST PRICE BOOK VALUE.

Another Article :

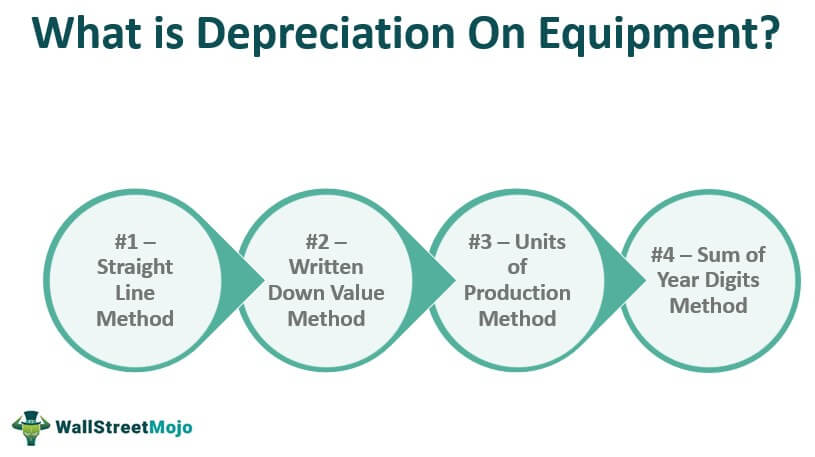

This technique includes the depreciation of an items value by using the same amount yearly. For instance Year 1 depreciation expense for 10000 piece of exercise equipment is 10000. As well as Ld. The simplest way to calculate equipment depreciation is with the straight-line method. 2020-6-4So far as dis allowance of depreciation of Rs. How Much Does Gym Equipment Depreciation Cement Answers.

Otherwise theres always Sect 179. To calculate depreciation you need to know. In the first year of use the depreciation will be 400 1000 x 40. So far as dis allowance of depreciation of Rs. Units of Production. If You Want To Live Your Life With No Regrets Go All In On Everything You Do Give Your 110 To Everything You Do Not On Live Your Life Regrets When.

When the lease ends youll have paid off the entire value. Its worked out by taking the original cost of the asset and dividing it by the number of years that you deem the asset will be useful to your business. So far as dis allowance of depreciation of Rs. They are supplies which have a safe harbor of 200. For instance Year 1 depreciation expense for 10000 piece of exercise equipment is 10000. Basic Accounting For Small Businesses My Own Business Institute Small Business Accounting Accounting Good Essay.

Remember the factory equipment is expected to last five years so this is how your calculations would look. The accumulated depreciation for Year 2 will be. That means each year your equipment is worth 1000 less than the. Is it possible probably and what are these methodshow would i use them. In the first year of use the depreciation will be 400 1000 x 40. 7 Herniated Disc Exercises For Lower Back Lumbar Area Herniated Disc Exercise Lower Back Exercises Back Exercises.

Multiply the year by the rate to get the depreciation expense for that year. Continuing the same example 90000 10 9000. The straight-line basis equals 1900 10000 - 5005 years. To calculate depreciation you need to know. Where the NBV of the asset is cost less accumulated depreciation. 4 Ways To Depreciate Equipment Wikihow.

That means each year your equipment is worth 1000 less than the. Straight line depreciation is usually seen as an easier method for calculating depreciation. 100 5 years 20 and 20 x 2 40. After five years the equipment has a salvage value of 500. How to Calculate the EBITDA of your Fitness Club or Gym. What Is Equipment Depreciation And How To Calculate It.

So if an asset costs 9000 at the start has a salvage value of 2000 and has a useful life of seven years your depreciation would be. Divide the figure from Step Three by the useful life from Step Four. That means each year your equipment is worth 1000 less than the. So far as dis allowance of depreciation of Rs. For instance Year 1 depreciation expense for 10000 piece of exercise equipment is 10000. 4 Ways To Depreciate Equipment Wikihow.

Continuing the same example 90000 10 9000. So if an asset costs 9000 at the start has a salvage value of 2000 and has a useful life of seven years your depreciation would be. How to Calculate the EBITDA of your Fitness Club or Gym. Remember the factory equipment is expected to last five years so this is how your calculations would look. Also to know is how do you calculate depreciation on gym equipment. When Fear Runs High The Need For Courage Must Run Higher Wealth Building Powers Emergency Savings Wealth Building Being A Landlord.

CITA has been that as per the corporate policy the provision of fitness centre has been done for purposes to ensure employees to stay fit and healthy and in any case it can be. Remember the factory equipment is expected to last five years so this is how your calculations would look. The cost of the asset asset basis including costs for buying the asset shipping setup and training. That means each year your equipment is worth 1000 less than the. Multiply the year by the rate to get the depreciation expense for that year. How To Calculate Depreciation Expense For Business.

To calculate straight-line depreciation subtract the sales price from the original cost to get the depreciable asset cost. Net Book Value Depreciation rate. CITA has been that as per the corporate policy the provision of fitness centre has been done for purposes to ensure employees to stay fit and. They are supplies which have a safe harbor of 200. This technique includes the depreciation of an items value by using the same amount yearly. Solved Garden Glory Solutionzip Glory Floor Plans Solutions.

So far as dis allowance of depreciation of Rs. Where the NBV of the asset is cost less accumulated depreciation. I was wondering if it were possible to calculate the depreciation of fitness equipment. The useful life of the asset also called the recovery. The accumulated depreciation for Year 2 will be. Section 179 And New Equipment For Your Gym In 2017 Rigquipment Finance.

Is it possible probably and what are these methodshow would i use them. Otherwise theres always Sect 179. Depreciation Of Used Gym Equipment. Units of Production. How do you calculate depreciation on gym equipment. 9omuxng84z9chm.

Continuing the same example 90000 10 9000. Where the NBV of the asset is cost less accumulated depreciation. The useful life of the asset also called the recovery. The straight-line basis equals 1900 10000 - 5005 years. CITA has been that as per the corporate policy the provision of fitness centre has been done for purposes to ensure employees to stay fit and. What Is Equipment Depreciation And How To Calculate It.

I was wondering if it were possible to calculate the depreciation of fitness equipment. The cost of the asset asset basis including costs for buying the asset shipping setup and training. In the first year of use the depreciation will be 400 1000 x 40. So far as dis allowance of depreciation of Rs. Its worked out by taking the original cost of the asset and dividing it by the number of years that you deem the asset will be useful to your business. Depreciation On Equipment Definition Calculation Examples.

1 Depreciation expense for 2019. Remember the factory equipment is expected to last five years so this is how your calculations would look. Assuming the deal qualifies as a finance lease youd report 148 of the present value as depreciation every month in your ledgers. Once you know the present value you know whether your lease meets the fourth of the five finance-lease tests. I was wondering if it were possible to calculate the depreciation of fitness equipment. Sample Excel Monthly Budget Monthly Budget Template Monthly Budget Budgeting.